The Power of the Mid-Segment

Opinion

The Power of the Mid-Segment

The mid-segment watch market has witnessed a notable resurgence, fueled by a combination of innovative designs, enhanced product offerings and the strategic positioning of brands that cater to both aesthetics and clever storytelling. Brands like Raymond Weil, Tissot, Furlan Marri, Frederique Constant, Louis Erard, Norqain, AnOrdain and Baltic are leading the charge, while new microbrands such as Anoma, Farer, Massena Lab, and Toledano & Chan are rapidly gaining traction. This revitalization comes in the wake of the challenges posed by wearable technology, particularly the Apple Watch, which significantly impacted the entry-level and the mid-segment by attracting a diverse consumer base. Even though it seems that sales of smart wearables have been on a decline since almost two years ago, the market leader Apple is gearing up its product offering by adopting the codes of traditional watchmaking with titanium cases and sapphire crystals that allow the brand to increase its margins. The positive flipside of this threat, represented by a disruptive technology embedded into an ecosystem where data is the key factor, is the fact that people have gotten used to — again — wearing something on their wrist. Ironically, the greatest threat for conventional watches in modern times has made them relevant again, because the wrist is still the most appropriate body part to wear a watch (unless you’re on a catwalk, in which case reading time on your ankle might seem fashionable).

Who’s Who in the Mid-Segment

The mid-price segment is not homogenous, but rather a patchwork of all sorts of concepts and brands. Many people are trying to compete for the favors of a mostly price-sensitive clientele and the sheer number of product and brand launches is staggering. It is estimated that every week, one or two new watch brands are launched somewhere in the world. Entering the market has never been as easy as it is today, thanks to social-media-based communication. The flip side is that the noise level is now very high at all times and that makes it challenging to attract attention if the brand’s content is not attractive enough. Besides, the time window to get this attention is extremely short.

1. The Microbrands

Most often launched through a crowdfunding campaign, or sometimes through a combination of “FFF” (friends, family and fools) and the first one, I would guess that out of 100 microbrand launches, only one or two manage to become a proper brand. The branding is very often mostly focused on the product and not so much on the brand’s purpose — the “why.”

They all try to go DTC (direct-to-consumer) at the beginning to preserve margins and, most importantly, the magic bond with the end-customer. Avoiding the traditional wholesale margins, they can offer their products at very interesting prices. The product is by definition niche and appealing to watch aficionados who can’t afford to pay the premium that goes with a premium brand.

The first step is sometimes successful, but the moment of truth comes with the next chapter, where they have to prove that they have a product strategy and that the first piece was not just an opportunistic move.

2. Niche Brands

They choose a niche target with a product that is more differentiated and sometimes also cleaving. The tribe feeling is triggered more by aesthetical choices than long-term brand values. Limited in their ambitions by the angle chosen with the product strategy, they have to be selective in their market strategy.

3. The Tribe or Community Brands

Being part of a tribe or a community around a brand or concept is sometimes more important than the product itself. There are two major and recent communities which were created around the theme of traditional watchmaking at accessible prices, Code41 and Baillod.

Both managed to rally large communities first around a distribution model cutting out the middlemen. Code41 started by making a lot of noise around a very clever marketing campaign, which consisted of shedding some light on an industry’s very opaque distribution structure and explaining why it could offer qualitative products at very competitive prices. Cutting out middlemen would reduce the number of layers of margins given and thus make it possible to offer attractive prices, rather than capture more margin for the brand. The concept, which turned into a brand, claims now that it is attracting an audience of more than 500,000 followers, which is rather impressive.

Code41 was extremely successful for a few years before a new player came along who was even more aggressive on pricing. Baillod (branded as BA111OD) is the new “enfant terrible” of the watchmaking industry and started with a concept very much similar to what Tupperware had done once upon a time — by recruiting the clients as active brand ambassadors dubbed “Afluendors.” Thomas Baillod is using the concept of “we-commerce” in which the Afluendors promote the watches to their own community or circle of friends.

In both cases, the long-term strategy to grow only through their own community was proven to be limited, because the digital activity needed to be enhanced by physical encounters. The so-much acclaimed marketing strategy of “phygital” (physical + digital) allows a brand to grow locally and regionally but not globally. That’s the tipping point bringing the brand back to reality and turning to traditional retail to promote its products. And retail means giving margin to a middleman — yes, the one meant to be cut out in the first place.

4. Historical or Institutional Brands

Most of them have a historical legacy, such as Tissot, Baume & Mercier or Hamilton, and are building an obvious storytelling based on that. Longines and Rado are also mid-range and often overlooked, but not many people know that the latter is the market leader in India, which is seen as one of the growth markets for watches in the mid-term.

Some are more recent, like Frederique Constant or Raymond Weil, but have managed to build up a consistent brand image with a narrative based on institutional values. These brands are offering traditional watchmaking at more accessible prices than the high-end brands from which they are taking the codes, both in terms of design and horological references.

Key Factors Driving the Mid-Segment Resurgence

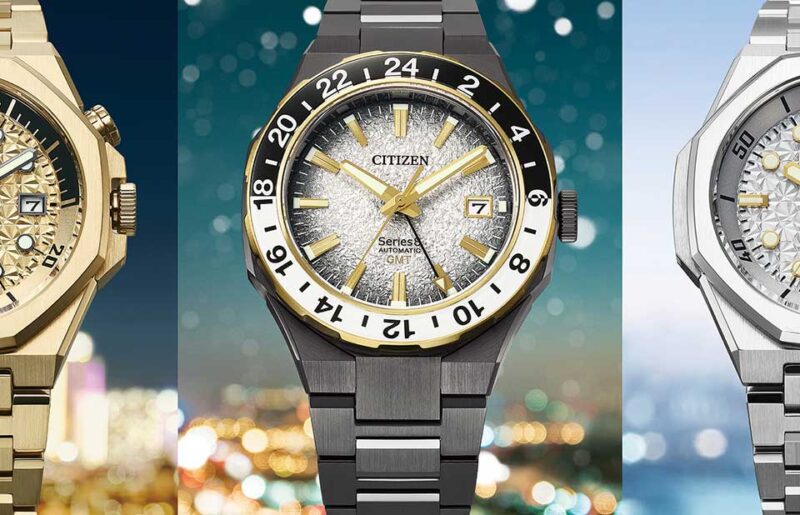

1. Diverse Offerings and Innovative Designs

Brands in this segment are focusing on unique aesthetics that appeal to both watch enthusiasts and casual wearers. For instance, Furlan Marri has made waves with its reinterpretations of iconic watches at an accessible price by using — at first — mechaquartz movements with very nice designs paying tribute to the finest periods and the finest brands in horological history. But the success of Furlan Marri has more to do with storytelling than watchmaking. “Undone” watches were launched a few years before and came probably from the same Chinese manufacturers that produced the first Furlan Marri watches. Undone was selling at roughly half the price of Furlan Marri, but there was no storytelling there.

The main trend pushing all the successful people in this price segment is the love of younger demographics for the designs of the 1960s to 1980s. The Tissot PRX is probably the most successful example of good product design, paired with incredible value for money with a top-notch Swiss-made mechanical movement and a strong brand equity. It has allowed the brand to sell probably more than one million pieces since its launch in 2021.

2. Quality and Craftsmanship

Companies like Frederique Constant and Raymond Weil emphasize quality craftsmanship, providing well-made timepieces that justify their price point without alienating themselves from aspirational buyers.

3. Affordability and Accessibility

The mid-segment serves as a bridge for consumers who appreciate luxury but are not ready to invest in high-end brands. This segment offers attractive options at a more accessible price range, making the allure of ownership attainable.

Microbrands like Anoma and Toledano & Chan are introducing limited runs and distinct styles that attract younger consumers seeking individuality without breaking the bank.

4. Engaging Marketing Strategies

Brands are increasingly leveraging social media and digital marketing to reach a broader audience. By highlighting their stories, unique heritage and design philosophy, they are able to foster a strong emotional connection with potential buyers.

Collaborations with influencers and participation in watch fairs are also instrumental in increasing visibility and engagement with a diverse consumer base.

5. Expansion of Collections

Many mid-segment brands are broadening their collections to include models that cater to various tastes, from vintage-inspired designs to modern, minimalist pieces. This variety enhances their appeal and helps capture the interest of different demographics.

Limited editions or special collaborations, like those seen with Baltic or Massena Lab, generate buzz and foster a sense of exclusivity, encouraging consumers to purchase before stocks run out. Massena Lab is based on a concept of collaboration and is not limited to any style or time period. The founder of Massena Lab, William Rohr, is probably one of the most watch literate personality in the small world of collectors and he is bringing his special touch on each collaboration.

6. Revitalized Consumer Interest

There is a growing trend among consumers to invest in quality, tangible products rather than ephemeral technology. This shift is particularly visible among millennials and Gen Z, who seek items that reflect personal style, craftsmanship and, last but not least, sustainability.

The stories behind brands, especially those influenced by heritage and artisanal practices, resonate well with consumers looking for more than just a functional watch.

Challenges and Opportunities Ahead

While the mid-segment faces continued competition from smartwatch technology, the caliber of offerings is attracting a previously untapped demographic. The challenge remains in maintaining a balance between craftsmanship and affordable pricing, ensuring that these brands do not compromise on quality to appeal to a lower price point.

The rebirth of the mid-segment watch market offers a unique opportunity for brands to redefine consumer interactions with traditional timepieces. By focusing on quality, innovation and storytelling, they can attract a wider audience, enticing those who may have previously overlooked this segment. As enthusiasm grows and microbrands continue to rise, the future for mid-segment watches looks promising, potentially rejuvenating the entire market landscape.